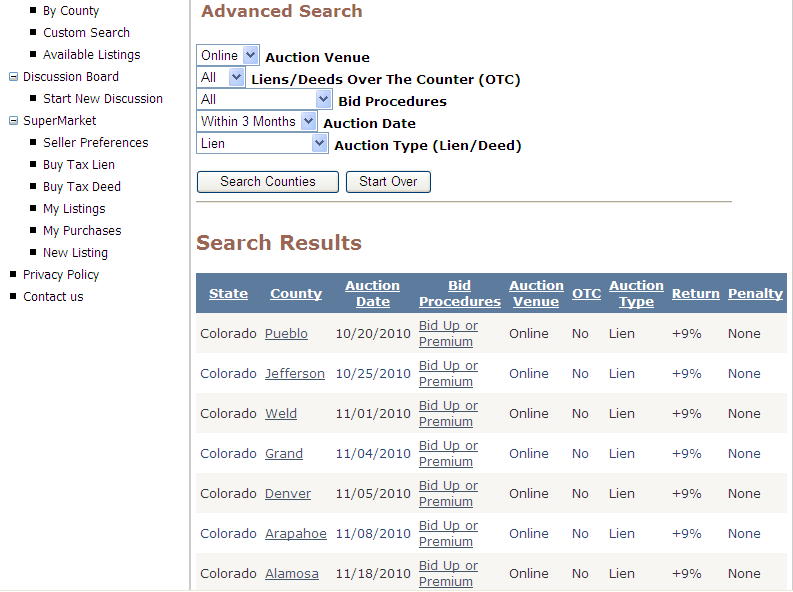

tax lien search colorado

A tax lien is a claim against a property imposed by law to secure the payment of taxes. Online Property Liens Information At Your Fingertips.

Make Money With Tax Liens Know The Rules Ted Thomas

Delinquent Real Property Taxes will be advertised once a week for 3 consecutive weeks prior to the annual.

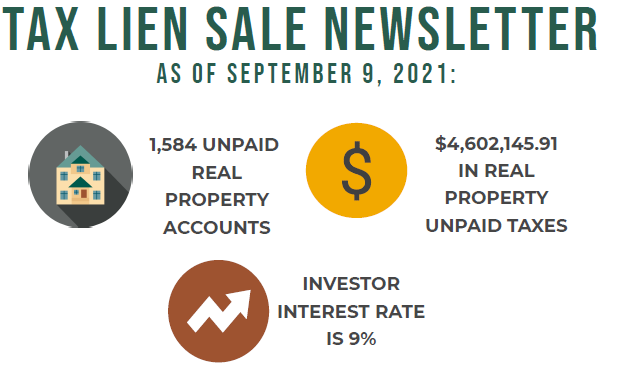

. Colorado currently has 45622 tax liens available as of February 18. The 2021 Tax Lien Sale will be held online on a date TBA. A holder of a Tax Lien Sale Certificate has the right to pay all subsequent years taxes which remain unpaid after all due dates expire.

Counties that use this method will have a starting bid that includes all delinquent taxes penalties and fees. The tax lien sale is the final step in the treasurers efforts to collect taxes on real property. Payment of Subsequent Taxes.

The Grand County tax lien sale is held online at the Grand County Official Tax Certificate Auction Site. Do not enter any additional search criteria. Quickly search tax records from 549 official databases.

OR Enter any combination of the following search criteria. Tax Lien Interest Rate for the 2020 auction will be 9. Delinquent Taxes and Tax Lien Sales Chaffee County Treasurer 104 Crestone Ave Salida CO 81201 Phone 719539-6808 Return to Top Return to Top Return to Top Return to Top Costilla.

The Tax Lien Sale Site is open for registration year-round. Find Tax Liens Mechanics Liens HOA Liens Judgments Divorce and Bankruptcy Records. For specific information about federal tax liens in Colorado see 38-25-101 through 38-25-107 CRS.

Ad Find Colorado Tax Lien. Bidding starts at the set. And state revenue agencies can place tax liens on parcels but the county treasurers office the.

A tax lien is a lien or a legal interest on a given tax parcel issued by a taxing entity. In accordance with 24-35-117 CRS the Colorado Department of Revenue is directed to annually disclose a list of delinquent taxpayers who have owed more. Sep 24 2014.

For information about federal tax liens contact the Internal Revenue Service. The Tax Lien Sale is the final step in the effort to collect. Ad Search by Address Owner Name Mailing Address or Parcel ID.

For certified records an additional 50 per title record or title history request must. The real estate tax lien public auction of. Parcel numbers beginning with 99000 or 99001 are for severed mineral interests.

A fee of 220 per searchhistory payable to the Colorado Department of Revenue must be submitted. Per Article 255 Title 38 a public entity in charge of taxes can attach a lien to the real or personal. The amount sold at the tax lien sale includes the unpaid taxes the county interest of 1 per month and the advertising fee.

Ad Search For County Records Info For Any Address. Please check back for more information. Looking for FREE property tax records assessments payments in Colorado.

A tax lien is placed on every county property owing taxes on January 1 each year and remains until. These tax liens will be reflected on the tax. To search by document enter a document and select Search.

Any unpaid taxes will be advertised for sale in the local newspaper and will be sold if they are still not paid by the day before tax lien public auction. Colorado Tax Liens Sale Type. The property owner is allowed to redeem the tax lien at any.

By taxlienwealth Sep 24 2014. If a property is wrongfully sold the interest paid to the purchaser shall be two points above the Discount Rate but no lower than 8. Colorado uses the Premium Bid method.

Public record property information and parcel maps are available on the Assessors Real Property Search. A tax lien in Colorado is imposed by the state or local government on delinquent taxpayers. The 2022 Internet Tax Lien Sale will be held on Nov 3 2022 2022 Interest TBD after Sept 1 2022 2021 Interest Rate was 9.

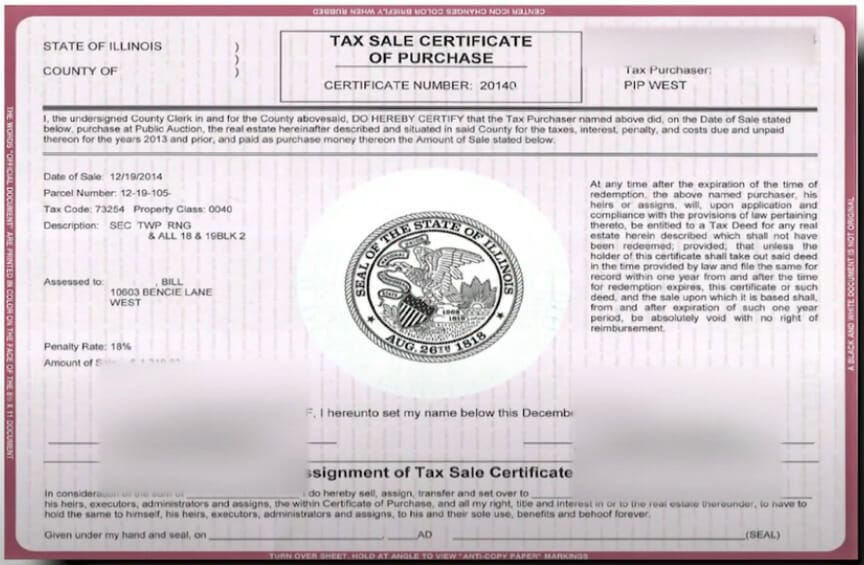

Box 1388 Englewood CO 80150 Judgments Liens The Colorado Department of Revenue CDOR is authorized to file a judgmentlien to collect your unpaid tax. Verify tax lien certificate issuance date has exceeded three years Submit application and 450 deposit After application submission and 450 deposit Process takes approximately six. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in.

Colorado Secretary of State.

Tax Lien Information Larimer County

The Free App We Use To Organize Our Tax Lien Deed Data Asana Youtube

Irs Puts 1 4 Billion Liens On Brockman S Aspen Properties Aspentimes Com

How To Find Tax Delinquent Properties In Your Area Rethority

Definition Can A Tax Lien Be Removed Fortress Tax Relief

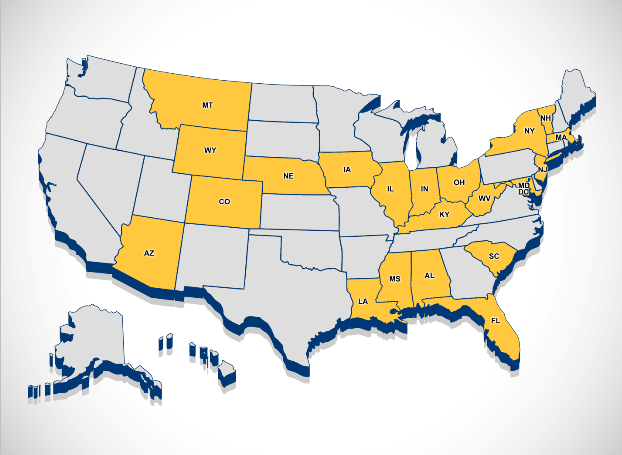

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

How To Remove Tax Liens From Your Credit Report Updated For 2022

Make Money With Tax Liens Know The Rules Ted Thomas

How To Find Out About Tax Sales Tax Lien Investing Tips

Tax Lien Investing Pros And Cons Youtube

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Colorado Tax Lien Auctions News With Stephen Swenson Of Tax Sale Support Learn About How Colorado Tax Lien Work And Investing Tutorial Investing Ebook Series

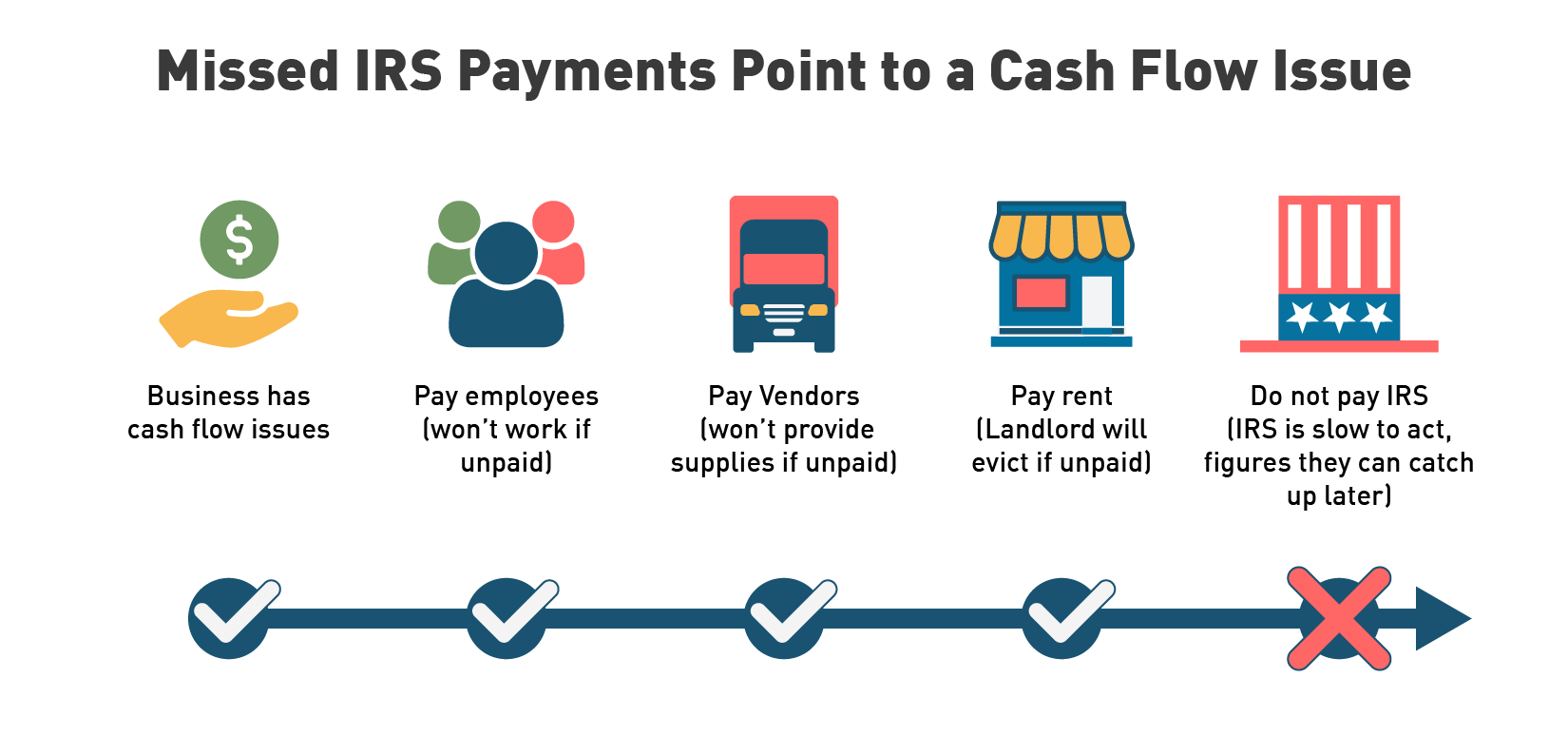

How To Spot A Cash Flow Problem Before It Hits Tax Guard

Good Morning Buy A House With Your Tax Refund As A Down Payment Because The Real Estate Market Is Unique Tax Refund Real Estate Marketing Home Buying

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Tax Lien Investing Is A Game Even Hedge Funds Can Like The Denver Post

Tax Lien Truths The Mountain Jackpot News

If You Have A Lien On Your Seattle House You May Feel Stuck If You Can T Sell The House Or Pay Off The Lien Things To Sell Sell Your House Fast

Larimer County Warns Of Tax Lien Scam Notices In The Mail Cbs Denver